Addendum concerning right to terminate due to lender’s appraisal – In the intricate world of real estate transactions, the addendum concerning the right to terminate due to lender’s appraisal stands as a crucial safeguard for both borrowers and lenders. This document empowers borrowers with the ability to terminate the loan agreement should the appraisal value fall short of the purchase price, ensuring their financial interests are protected.

Understanding the significance of this addendum is paramount for navigating the complexities of the mortgage process.

The lender’s appraisal plays a pivotal role in determining the loan amount and interest rate, making it an essential factor in securing favorable loan terms. However, discrepancies between the appraisal value and the purchase price can arise, potentially jeopardizing the borrower’s financial stability.

The addendum concerning the right to terminate addresses this potential disparity, providing borrowers with a safety net in such situations.

Introduction

An addendum concerning the right to terminate due to lender’s appraisal is a crucial document that safeguards the interests of both borrowers and lenders in a mortgage transaction. It provides the borrower with the option to terminate the loan agreement if the appraisal value falls below the purchase price.

This addendum is particularly important for borrowers who are purchasing a home with a small down payment or who are relying on the appraised value to qualify for a loan. It ensures that they are not obligated to purchase a property that is worth less than the amount they agreed to pay.

Lender’s Appraisal

A lender’s appraisal is an independent assessment of a property’s value, conducted by a licensed appraiser. The appraisal value is used by the lender to determine the loan amount and interest rate.

If the appraisal value is lower than the purchase price, the lender may reduce the loan amount or increase the interest rate. This can make the mortgage unaffordable for the borrower.

Borrower’s Right to Terminate: Addendum Concerning Right To Terminate Due To Lender’s Appraisal

The borrower’s right to terminate the loan agreement if the appraisal value is below the purchase price is a fundamental protection for consumers. This right is typically exercised within a specified timeframe after the appraisal is received.

To exercise this right, the borrower must provide written notice to the lender within the specified timeframe. The notice should state that the borrower is terminating the loan agreement due to the appraisal value being below the purchase price.

Exceptions to the Right to Terminate

There are a few exceptions to the borrower’s right to terminate based on appraisal value. These exceptions include:

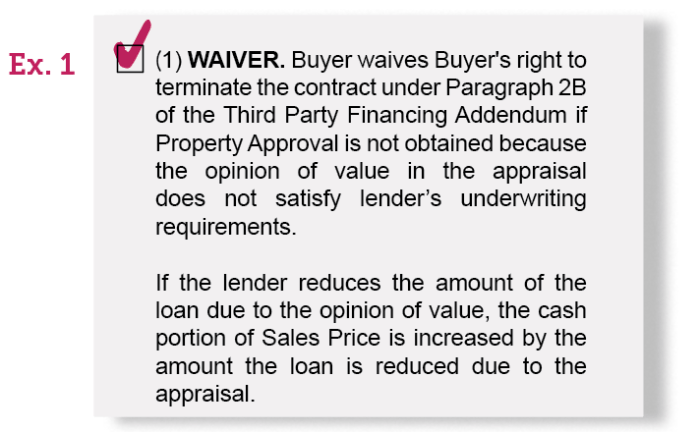

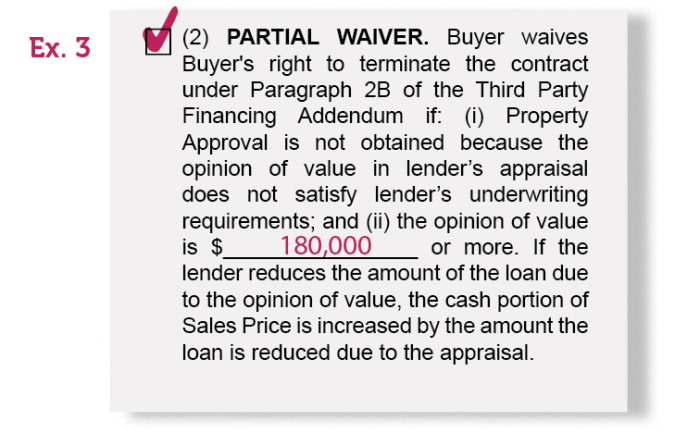

- The borrower waives the right to terminate in writing.

- The lender agrees to increase the loan amount to cover the difference between the appraisal value and the purchase price.

- The borrower agrees to purchase the property at the appraisal value.

Negotiating the Addendum

The terms of the addendum concerning the right to terminate due to lender’s appraisal should be negotiated before signing the loan agreement. Borrowers should carefully review the addendum and make sure that they understand its terms.

Borrowers should also consider negotiating the following terms:

- The timeframe for exercising the right to terminate.

- The circumstances under which the lender may be obligated to allow termination.

- The consequences of violating the terms of the addendum.

Legal Implications

The addendum concerning the right to terminate due to lender’s appraisal is a legally binding document. Violating the terms of the addendum can have serious consequences.

For example, if a borrower terminates the loan agreement without a valid reason, they may be liable for damages. These damages may include the lender’s costs of obtaining a new appraisal and marketing the property.

Question & Answer Hub

What is the purpose of the addendum concerning the right to terminate due to lender’s appraisal?

The addendum protects borrowers by allowing them to terminate the loan agreement if the appraisal value falls below the purchase price, ensuring they are not financially obligated to purchase a property that is overvalued.

When can a borrower exercise the right to terminate based on appraisal value?

The specific timeframes and procedures for exercising this right vary depending on the lender and the terms of the addendum, but typically borrowers have a limited time frame after receiving the appraisal to notify the lender of their intent to terminate.

Are there any exceptions to the borrower’s right to terminate based on appraisal value?

Yes, there may be exceptions in cases where the appraisal value is within a certain percentage of the purchase price or if the borrower has waived their right to terminate in the loan agreement.

Why is it important to negotiate the terms of the addendum before signing the loan agreement?

Negotiating the terms of the addendum allows borrowers to clarify the conditions under which they can terminate the loan agreement and ensure their interests are protected.

What are the potential consequences of violating the terms of the addendum?

Violating the terms of the addendum could result in the borrower losing their right to terminate the loan agreement or facing legal action from the lender.