How much will the Peruvian government spend on servicing? This question raises concerns about the potential economic consequences, fiscal responsibility, and budget allocation. Understanding the implications of this spending is crucial for assessing its impact on Peru’s financial stability and the well-being of its citizens.

The Peruvian government’s spending on servicing has significant economic implications. It can affect inflation, interest rates, and economic growth. Moreover, it can impact the standard of living for the Peruvian people. Analyzing the fiscal responsibility of the government in relation to this spending is essential to ensure its sustainability in the long term.

Economic Impact

The Peruvian government’s spending on servicing has a range of potential economic consequences, both positive and negative.

On the positive side, this spending can help to stimulate economic growth by increasing demand for goods and services. It can also lead to lower interest rates, which can make it easier for businesses to borrow money and invest.

On the negative side, this spending can also lead to inflation if the government borrows too much money or if the economy is already running at full capacity.

Impact on Inflation

The government’s spending on servicing can lead to inflation if it borrows too much money or if the economy is already running at full capacity. This is because the government will have to compete with private businesses for resources, which can drive up prices.

Impact on Interest Rates

The government’s spending on servicing can also lead to lower interest rates. This is because the government is a relatively safe borrower, so investors are willing to lend it money at a lower rate.

Impact on Economic Growth

The government’s spending on servicing can help to stimulate economic growth by increasing demand for goods and services. This is because the government is a major consumer of goods and services, and its spending can help to create jobs and boost the economy.

Fiscal Responsibility

The Peruvian government has a responsibility to ensure that its spending on servicing is sustainable in the long term. This means that the government must not borrow more money than it can afford to repay.

The government’s fiscal responsibility is also important for maintaining the confidence of investors. If investors believe that the government is not fiscally responsible, they may be less willing to lend it money, which can lead to higher interest rates and a weaker economy.

Sustainability of Spending

The sustainability of the government’s spending on servicing depends on a number of factors, including the level of economic growth, the interest rate, and the government’s overall fiscal position.

If the economy is growing strongly, the government can afford to borrow more money to service its debt. However, if the economy is not growing, the government may have to cut spending or raise taxes in order to avoid defaulting on its debt.

Risks and Benefits of Fiscal Strategy

The Peruvian government’s fiscal strategy has a number of risks and benefits. On the one hand, the government’s strategy has helped to stimulate economic growth and reduce poverty. On the other hand, the government’s strategy has also led to a significant increase in the national debt.

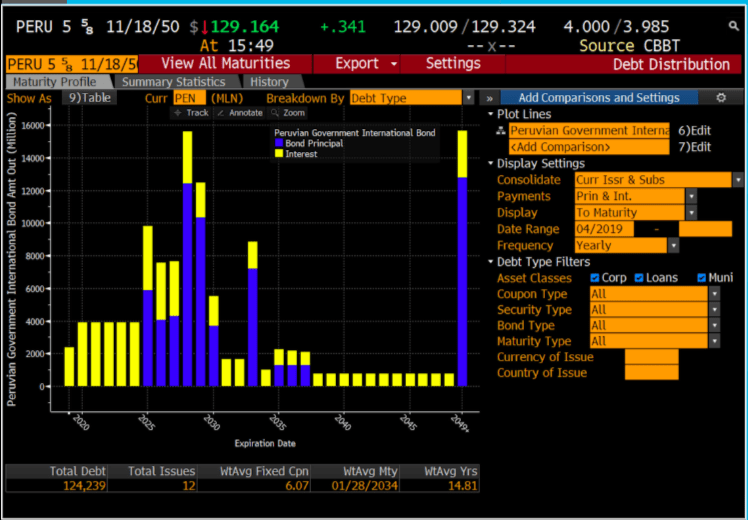

Budget Allocation

The Peruvian government’s budget allocation for servicing is divided into two main categories: interest payments and principal repayments.

Interest payments are the payments that the government makes to its creditors for the use of their money. Principal repayments are the payments that the government makes to its creditors to repay the original amount of money that it borrowed.

The government’s budget allocation for servicing has been increasing in recent years. In 2022, the government allocated approximately 10% of its total budget to servicing.

Distribution of Funds

The government’s budget allocation for servicing is distributed to a number of different creditors, including domestic banks, international financial institutions, and private investors.

The government’s largest creditor is the domestic banking sector. In 2022, the government allocated approximately 60% of its budget allocation for servicing to domestic banks.

Areas for Optimization

There are a number of areas where the government could optimize its spending on servicing. For example, the government could reduce its reliance on domestic banks and borrow more money from international financial institutions and private investors.

The government could also explore ways to reduce the interest rate on its debt. This could be done by improving the government’s fiscal position or by negotiating with its creditors.

Comparative Analysis

The Peruvian government’s spending on servicing is comparable to that of other countries in the region. For example, in 2022, the Peruvian government allocated approximately 10% of its total budget to servicing, while the Brazilian government allocated approximately 12% and the Colombian government allocated approximately 8%.

However, there are some differences in the spending patterns of different countries. For example, the Peruvian government spends a higher proportion of its budget on servicing than the Brazilian government, but a lower proportion than the Colombian government.

Implications for Fiscal Policy

The Peruvian government’s spending on servicing has a number of implications for its fiscal policy. For example, the government’s high level of spending on servicing limits its ability to spend money on other priorities, such as education and healthcare.

The government’s spending on servicing also makes it more vulnerable to changes in the interest rate. If interest rates rise, the government will have to spend more money on servicing its debt, which could lead to fiscal problems.

Outlook and Recommendations: How Much Will The Peruvian Government Spend On Servicing

The outlook for the Peruvian government’s spending on servicing is uncertain. The government’s spending on servicing is likely to increase in the short term, as the government continues to borrow money to finance its budget deficit.

However, the government’s spending on servicing is likely to decline in the long term, as the government reduces its budget deficit and improves its fiscal position.

Key Factors

There are a number of key factors that will influence the future of the Peruvian government’s spending on servicing. These factors include the level of economic growth, the interest rate, and the government’s overall fiscal position.

Recommendations, How much will the peruvian government spend on servicing

The Peruvian government should take a number of steps to improve its spending on servicing. These steps include reducing its reliance on domestic banks, exploring ways to reduce the interest rate on its debt, and improving its fiscal position.

Questions and Answers

What are the potential economic consequences of the Peruvian government’s spending on servicing?

The potential economic consequences include inflation, higher interest rates, and slower economic growth.

How does the government’s spending on servicing impact the Peruvian people’s standard of living?

It can affect the availability and affordability of essential services such as healthcare, education, and infrastructure.

Is the Peruvian government’s spending on servicing fiscally responsible?

The sustainability of this spending in the long term depends on factors such as economic growth, inflation, and the government’s overall fiscal strategy.