Sasha spends 3/8 of her money on a game – Sasha’s financial habits have placed her in a precarious situation, as she allocates a significant portion of her income to a game. This captivating narrative delves into the consequences of her spending, exploring the impact on her financial well-being and the strategies she can employ to regain control of her finances.

Sasha’s financial journey serves as a cautionary tale, highlighting the importance of responsible budgeting and financial planning. By examining her spending patterns and identifying alternative entertainment options, readers will gain valuable insights into managing their own finances effectively.

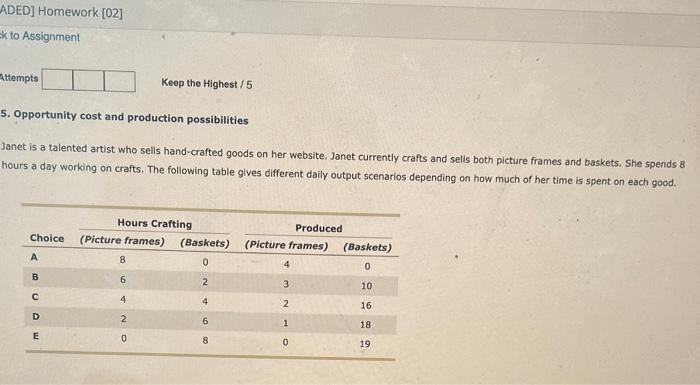

Sasha’s Budget Allocation: Sasha Spends 3/8 Of Her Money On A Game

Sasha’s spending habits have a significant impact on her financial situation. By allocating 3/8 of her income to a game, she may be neglecting other essential expenses. This can lead to financial difficulties, such as debt accumulation and a reduced ability to save for the future.

To improve her financial situation, Sasha could adjust her budget by reducing her game expenses and reallocating the funds to other categories. For example, she could increase her savings contributions, pay down debt, or invest in her education.

Impact of Game Expenses, Sasha spends 3/8 of her money on a game

Spending a significant portion of her income on a game can have several negative consequences. First, it can limit her ability to meet other financial obligations, such as rent, utilities, and groceries.

Second, it can result in opportunity cost. By prioritizing game expenses over other financial goals, Sasha may be missing out on potential returns on investment or opportunities to improve her financial well-being.

Financial Planning Strategies

To manage her finances effectively, Sasha can implement several strategies. First, she should track her expenses to identify areas where she can reduce spending. Second, she should set financial goals, such as saving for a down payment on a house or retiring early.

Third, she should create a budget that allocates her income to different categories, such as housing, transportation, and entertainment. By following a budget, Sasha can ensure that her expenses do not exceed her income and that she is saving for her future goals.

Alternative Entertainment Options

Sasha can engage in alternative entertainment options that do not incur significant expenses. These options include reading, exercising, spending time with friends and family, or volunteering.

| Activity | Cost | Benefits |

|---|---|---|

| Reading | Free or low-cost | Stimulates the mind, reduces stress, and expands knowledge |

| Exercising | Free or low-cost | Improves physical and mental health, boosts mood, and reduces stress |

| Spending time with friends and family | Free or low-cost | Strengthens relationships, provides emotional support, and creates lasting memories |

| Volunteering | Free | Makes a positive impact on the community, develops skills, and provides a sense of purpose |

Budgeting Tools and Resources

Sasha can utilize several online budgeting tools and resources to manage her finances. These include:

- Mint: A free budgeting app that tracks expenses, sets financial goals, and creates budgets.

- YNAB (You Need A Budget): A paid budgeting software that helps users track their expenses and create a budget based on their income and goals.

- Bank of America’s budgeting tools: A suite of budgeting tools offered by Bank of America, including a budget tracker, expense analyzer, and savings calculator.

Helpful Answers

What factors contribute to Sasha’s financial difficulties?

Sasha’s financial struggles stem from her excessive spending on a game, which consumes 3/8 of her income. This significant allocation of funds leaves her with limited resources to cover other essential expenses and financial obligations.

What strategies can Sasha implement to improve her financial situation?

Sasha can improve her financial situation by creating a budget that tracks her expenses and sets financial goals. She should also explore alternative entertainment options that are less expensive than the game she currently plays.

What are the consequences of prioritizing game expenses over other financial obligations?

Prioritizing game expenses over other financial obligations can lead to debt, financial stress, and a diminished ability to achieve long-term financial goals. It can also impact Sasha’s credit score and limit her access to financial products and services.